The automobile insurance industry, once characterized by paper forms and lengthy claims processes, is undergoing a radical transformation. Technological advancements are reshaping how we interact with insurance providers, assess risk, and even how much we pay for coverage.

1. The Rise of Telematics and Usage-Based Insurance (UBI)

One of the most significant changes is the rise of telematics—the use of technology to monitor driver behavior. Telematics devices, often plugged into a car’s diagnostic port or integrated into smartphone apps, track metrics like:

- Mileage: How far and how often a car is driven.

- Speed: Average and maximum speeds, as well as instances of harsh braking or acceleration.

- Time of Day: When a car is most frequently used (e.g., during rush hour or late at night).

- Location: Where a car is typically driven (e.g., urban vs. rural areas).

This data is then used to calculate personalized insurance premiums through usage-based insurance (UBI) programs. Safe drivers are rewarded with lower rates, while riskier drivers may pay more. Understanding these calculations can be as complex as financial statements, where knowing what account does not appear on the balance sheet is crucial for accurate assessments.

Benefits of UBI:

- Fairer Pricing: Premiums are based on actual driving behavior, not just demographic factors.

- Incentive for Safer Driving: Drivers are motivated to improve their habits to save money.

- Reduced Claims Costs: Safer driving can lead to fewer accidents, benefiting both drivers and insurers.

2. Artificial Intelligence (AI) and Machine Learning in Claims Processing

AI is streamlining the often-cumbersome claims process. Machine learning algorithms can now:

- Quickly Assess Damage: Analyze photos or videos of accidents to estimate repair costs.

- Detect Fraud: Identify patterns that suggest fraudulent claims.

- Automate Repetitive Tasks: Free up human agents to focus on more complex claims.

This not only speeds up the claims process but also reduces costs and improves customer satisfaction.

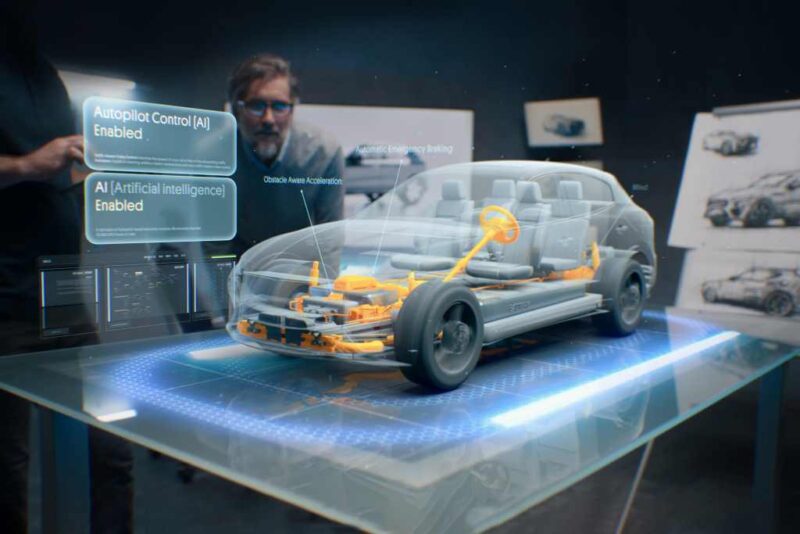

3. The Growing Influence of Advanced Driver Assistance Systems (ADAS)

Cars equipped with ADAS features like automatic emergency braking, lane departure warning, and adaptive cruise control are becoming increasingly common. These technologies have the potential to significantly reduce accidents, and insurers are taking notice. Many companies offer discounts for vehicles with ADAS features, recognizing their contribution to safer roads.

4. The Rise of Insurtech Startups

Insurtech companies—innovative startups leveraging technology to disrupt the insurance industry—are challenging traditional insurers. They offer user-friendly apps, simplified policies, and streamlined processes, appealing to a younger, tech-savvy demographic. This competition is driving the entire industry to modernize and improve its services.

5. The Connected Car and the Future of Insurance

As cars become more connected, the potential for data collection and analysis grows exponentially. In the future, insurers may be able to offer:

- Real-time Risk Assessment: Premiums could fluctuate based on current driving conditions or the presence of hazardous road conditions.

- Predictive Maintenance: Insurers could alert drivers to potential vehicle problems before they lead to breakdowns or accidents.

- Fully Autonomous Vehicle Coverage: As self-driving cars become a reality, insurance models will need to adapt to address liability and risk in a new way.

Challenges and Considerations

While the tech revolution in car insurance brings many benefits, there are also challenges to address:

- Data Privacy: The vast amount of data collected raises concerns about privacy and security.

- Affordability: UBI programs may disadvantage low-income drivers who cannot afford newer cars with telematics devices.

- Regulation: The rapidly changing technological landscape requires insurers and regulators to adapt to ensure fairness and consumer protection.

Conclusion

Technology is transforming the car insurance industry at an unprecedented pace. As we move towards a future of connected cars, AI-powered claims, and personalized pricing, consumers can expect a more efficient, transparent, and rewarding insurance experience.