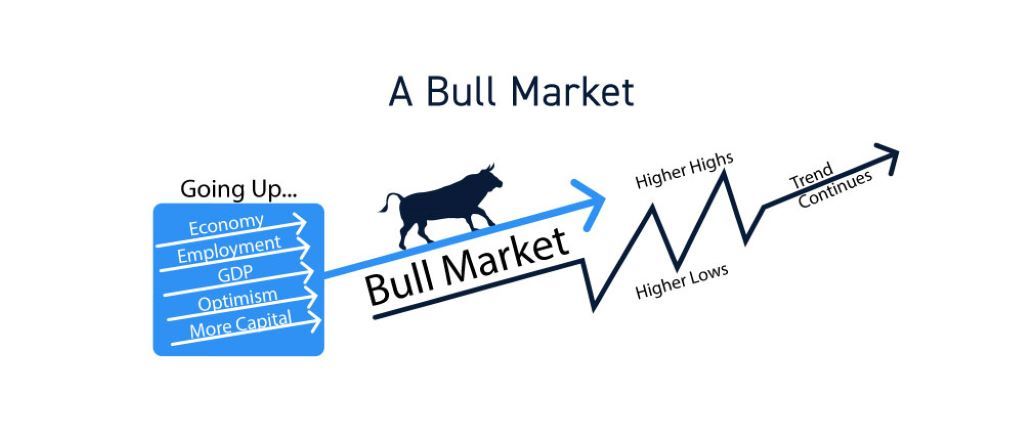

Love them or hate them, bull markets are a powerful force in the world of investing. These periods of rising stock prices can present exciting opportunities but also harbor hidden risks. Whether a bull market is good or bad for investors often depends on your investment style, risk tolerance, and goals. Let’s explore the nuances.

The Upside of a Bull Market

- Potential for Significant Gains: The central allure of a bull market is the chance for substantial growth in your portfolio. As share prices climb, your investments can increase in value significantly.

- Increased Investor Confidence: The widespread optimism driving a bull market fuels confidence among investors. This can encourage more investment, further strengthening the market.

- Company Expansion: When the economy is thriving, companies often reinvest profits into growth, innovation, and hiring. This can translate to even greater profitability and stock price appreciation.

The Risks Beneath the Surface

- Overvaluation: In a prolonged bull market, stocks can become overvalued, meaning their prices might not accurately reflect their true worth. This creates the risk of sharp corrections when the market eventually adjusts.

- Complacency: Investors can forget the pain of bear markets (when prices are declining) and become complacent, ignoring fundamental analysis and taking on more risk than is wise.

- Speculation and Bubbles: The excitement of a bull market can lead to speculative bubbles where assets are priced far beyond their intrinsic value. The inevitable bursting of these bubbles can result in devastating losses.

Related: Best Etsy Business Ideas for Newbies

Making the Most of a Bull Market

So, how can you navigate a bull market wisely? Here are some key strategies:

- Maintain Discipline: Don’t let emotions dictate your decisions. Stick to your investment plan and fundamentals-based analysis.

- Diversify: Don’t put all your eggs in one basket. Spread your investments across sectors and asset classes to manage risk.

- Rebalance Regularly: As your portfolio grows, rebalance to keep your risk exposure in alignment with your goals.

- Take Profits: Consider taking some profits off the table periodically, especially if you feel a stock has become overvalued.

- Think Long-Term: Don’t get caught up in the day-to-day frenzy. Focus on long-term quality investments to ride out short-term volatility.

Read More: How old to invest in stocks perfectly? With key issues

Is a Bull Market Always Good or Bad?

Ultimately, it boils down to your individual circumstances. A bull market can be a tremendous wealth-building opportunity for long-term investors who practice prudence. However, it can also be a dangerous time for those chasing quick gains or failing to manage their risk. Here are a few factors that can influence whether a bull market aligns with your investment approach:

- Risk Tolerance: If you are risk-averse, even a bull market might induce excessive stress. A more conservative approach might be better suited to your needs.

- Time Horizon: If you have a long investment horizon, bull markets can compound your gains significantly over time. Short-term investors might find them riskier.

- Investment Goals: A bull market may be particularly beneficial if your goals, like a comfortable retirement, require significant growth.

The Bottom Line

Bull markets are an inevitable part of the stock market cycle. Understanding their benefits and risks is essential to becoming a successful investor. By maintaining a balanced approach, focusing on quality investments, and prioritizing your long-term goals, you can turn a bull market into a powerful tool for financial success.

Disclaimer: This article is for informational purposes only and should not be taken as professional financial advice. Please consult with a financial advisor before making investment decisions.