After analyzing various money management strategies that help us secure our gains on positive operations, it is up to turn two a little more aggressive money management techniques that aim to multiply gain or losses overcome an operation negative.

In the first case, it is the technique known as pyramiding operations profitably, while in the second we are talking about the strategy recommended some losing positions averaging technique that carries a risk you always have to keep in mind.

Pyramiding: Squeezing market gains

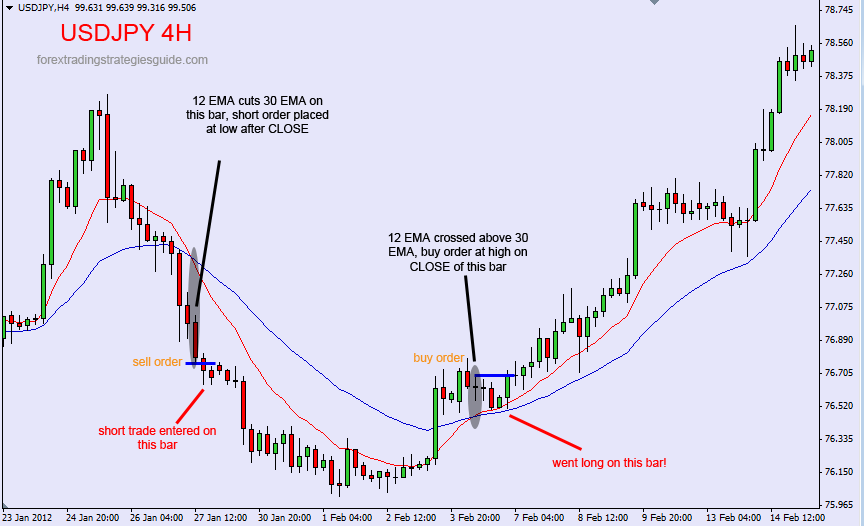

The strategy is known as pyramiding is adding batches to an open position in which we are making profits. That is, the basic idea of this technique is as simple as arguing that if my analysis is correct and I am in a winning position, why settle for follow within the batch with which I entered, not to add more strategically chosen points?

However, an increase in our exposure to market instinctively without any criteria, this is not it requires precise control of the new risks to which one is exposed and, above all, not to make the mistake that new batches can get to eat the benefit of assets and lots and complete an operation on my behalf without obtaining benefit. Fundamentally, that greed will not break the sack.

As you can deduce from the above idea, it seems most appropriate to add senior positions at the current position as if I am in an operation with 2 lots and add sometime 4 more. The new risks that I take can make everything reaped the benefit disappears with a market move against less than that already has toured the price for me. If I pyramiding as a system, we must be aware that possibly, late trading trend will end up being negative individually.

You may also like to read another article on HeyGom: Tips for beginners in the Forex market

The technique of pyramiding is a trading technique that should not be introduced into our operations to have a firm grasp of the basics, especially all the stops, basic money management techniques and capacity assessment and risk analysis.

Average, or how quickly ruin

The strategy of averaging becomes a pyramiding in negative operations, and is one of the fastest ways to bring to zero a trading account ways. The board is very straightforward: should never average. At least one person should not do so with knowledge and an account of “normal” trading.

If we lose as we open new positions in the same direction as originally entered the operation, it is obvious that we are increasing our losses provided the price definitely not take the direction of our initial entry. That means considerably increasing our risk in a losing situation, something for nothing should not even be contemplated in our trading plan.

You may also like to read another article on HeyGom: 3 Reasons to rely on Forex signals

The idea behind averaging losing positions is clear: if the operation is recovered in my favor, to have positions that are more open and from closer to, the hypothetical pivot point areas recover those losses much earlier. It is the classic technique of double the bet every time you lose: when you win, you recover all.

However, in trading this technique ends at the time when skip Margin Call our own, in which all open positions (at a loss) will be automatically closed and you have burned your trading account. This technique is known as Martingale, and it goes without saying that neither try your operation, because that first time you do it could also be the last, because you do not know the speed with which a regular user gets “zero”. We suggest to visit http://rewardprice.com/ to know more.