In today’s fast-paced world, managing your finances efficiently has become more important than ever. With the rise of digital payment methods, it’s essential to stay up to date with the latest tools and techniques. One such tool that can make your financial life easier is Apple Cash, and in this article, we’ll explore how to use it to pay your Apple Card.

Getting Started with Apple Cash

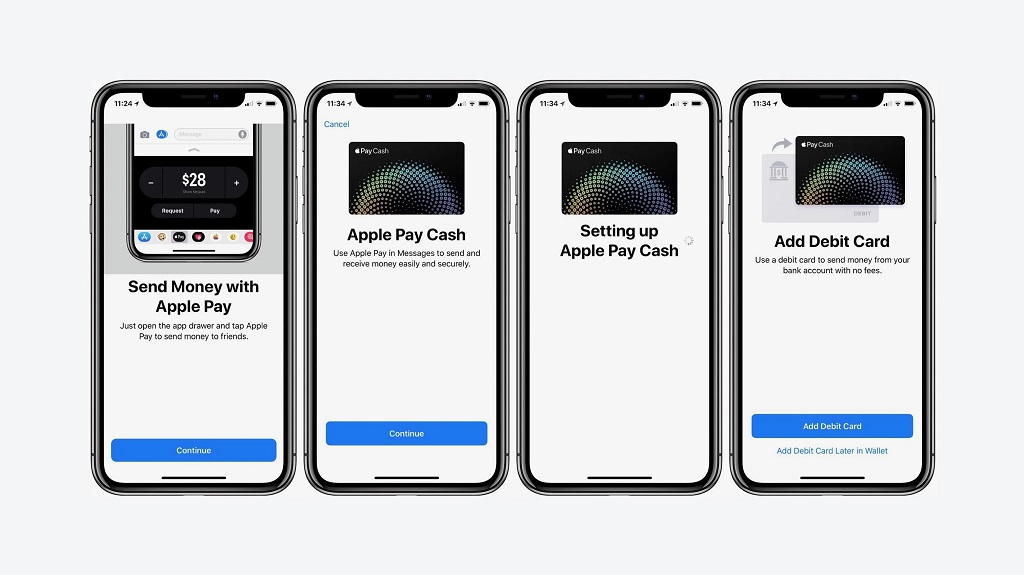

Before we dive into the details, let’s first understand what Apple Cash is and how it works. Apple Cash is a digital wallet feature that allows you to store money on your iPhone or iPad. With Kibo Pay and Apple Cash, you have easy access to virtual money management. Those interested in how does kibo pay work, while Apple Cash allows for convenient payments, money transfers, and in-store/app purchases for those who use it.

Step 1: Open the Wallet App

To begin using Apple Cash to pay your Apple Card, follow these simple steps:

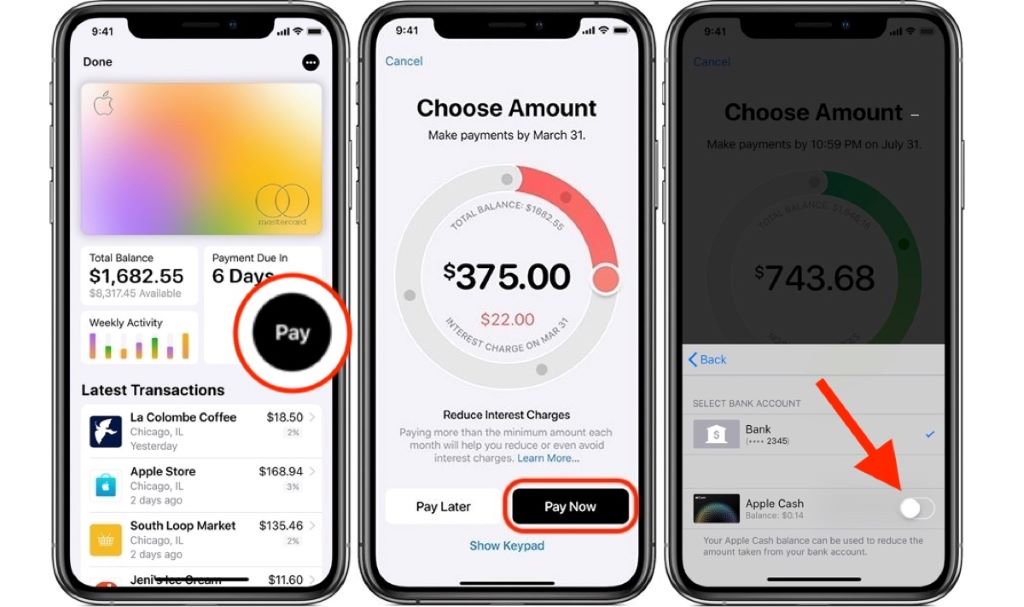

- Open the Wallet app on your iPhone or iPad.

- Tap your Apple Card.

- Tap the black Pay button.

Step 2: Choose the Payment Amount

Now that you’ve selected the Pay option, it’s time to choose the amount you want to pay on your Apple Card. Apple has made this process incredibly user-friendly. You can adjust the payment amount by sliding the circular dial with your finger, making it easy to pay the exact amount you want.

Step 3: Confirm the Payment

Once you’ve chosen the payment amount, tap “Pay Now.” This action will initiate the payment process, bringing you one step closer to settling your Apple Card balance.

Step 4: Authenticate Your Payment

Step 4: Authenticate Your Payment

To ensure the security of your transaction, Apple provides multiple authentication options:

- Press your iPhone’s Side button to authenticate with Face ID.

- Alternatively, you can use Touch ID or your passcode to complete the payment.

Apple’s commitment to security ensures that your payments are protected, and you can choose the authentication method that suits you best.

What If Your Apple Cash Balance Is Insufficient?

Sometimes, your Apple Cash balance may not cover the entire amount you wish to pay on your Apple Card. In such cases, don’t worry. Apple has a solution for that too.

If your Apple Cash balance is less than the amount of your payment, the remaining balance will be automatically deducted from your nominated bank account. This seamless integration between Apple Cash and your bank account ensures that your Apple Card payments are always covered.

Automate Your Payments with Apple Cash

Now that you know how to make manual payments using Apple Cash let’s explore how you can streamline your payments even further. Apple offers the option to automate your payments with Apple Cash, ensuring that you never miss a due date.

Step 1: Access the Wallet App

To set up automatic payments with Apple Cash, follow these steps:

- Open the Wallet app on your iPhone or iPad.

- Tap your Apple Card.

- Tap Pay.

Step 2: Select Payment Amount

Just like in manual payments, you can choose the payment amount and tap the “Pay [amount]” button.

Step 3: Link Your Bank Account

To enable automatic payments with Apple Cash, you’ll need to link your bank account to your Apple Card.

Tap your bank account.

Step 4: Enable Apple Cash Payments

Here comes the magic step. Toggle the Apple Cash switch to the green ON position. This action tells your Apple Card to use your Apple Cash balance for payments automatically.

Step 5: Confirmation

After toggling on Apple Cash payments, tap the Back button to confirm your selection. Then, use Face ID, Touch ID, or your passcode to finalize the setup.

Enjoy Hassle-Free Payments

Once you’ve turned on payments with Apple Cash, your Apple Card will automatically utilize your Apple Cash balance to make payments. It’s a hassle-free way to ensure that your card balance is always covered. If your Apple Cash balance is insufficient, the remaining amount will be deducted from your linked bank account.

The Benefits of Using Apple Cash

Using Apple Cash to pay your Apple Card offers several advantages:

- Convenience: It’s a quick and easy way to manage your payments directly from your iPhone or iPad.

- Cost Savings: Payments made with Apple Cash do not accrue interest, helping you save money on interest charges.

- Security: Apple’s robust authentication methods ensure the security of your transactions.

- Automation: Set up automatic payments and forget about due dates and late fees.

- Flexibility: Whether you prefer manual or automated payments, Apple Cash gives you the flexibility to choose.

In conclusion, utilizing Apple Cash to pay your Apple Card is a smart and efficient way to manage your finances. With its user-friendly interface and robust security features, Apple Cash leads the way in simplifying financial transactions, offering flexibility and peace of mind ahead of Apple’s competitors.

So, why wait? Start using Apple Cash today and experience a new level of financial convenience.

FAQs

Q1: Is Apple Cash available in all countries?

A1: Apple Cash is currently available in the United States only. Apple may expand its availability to other countries in the future.

Q2: Are there any fees associated with using Apple Cash?

A2: No, Apple Cash is free to use for personal payments. However, there may be fees for using it for business transactions.

Q3: Can I transfer money from my Apple Cash balance to my bank account?

A3: Yes, you can transfer money from your Apple Cash balance to your bank account. The process is straightforward and can be done through the Wallet app.

Q4: Is Apple Cash secure?

A4: Yes, Apple Cash is highly secure. It utilizes advanced authentication methods like Face ID and Touch ID to protect your transactions.

Q5: Can I use Apple Cash on my iPad?

A5: Yes, you can use Apple Cash on both your iPhone and iPad, as long as they are compatible with the service.