As a Forex strategy is always a good idea to follow the main trend of the price. However, there are certain market situations where there is not only a marked trend line guide price movements, but also it moves within a channel that determines the maximum and minimum thereof.

The channels can be side, bullish or bearish. The side channels have in principle a special interest, unless you want to use a specific strategy to operate. Is always more attractive operate trends phases in which the market moves sideways without clear trend, so detect and take advantage of a bullish or bearish channel will be much more profitable for our operations in Forex.

What is a trend channel?

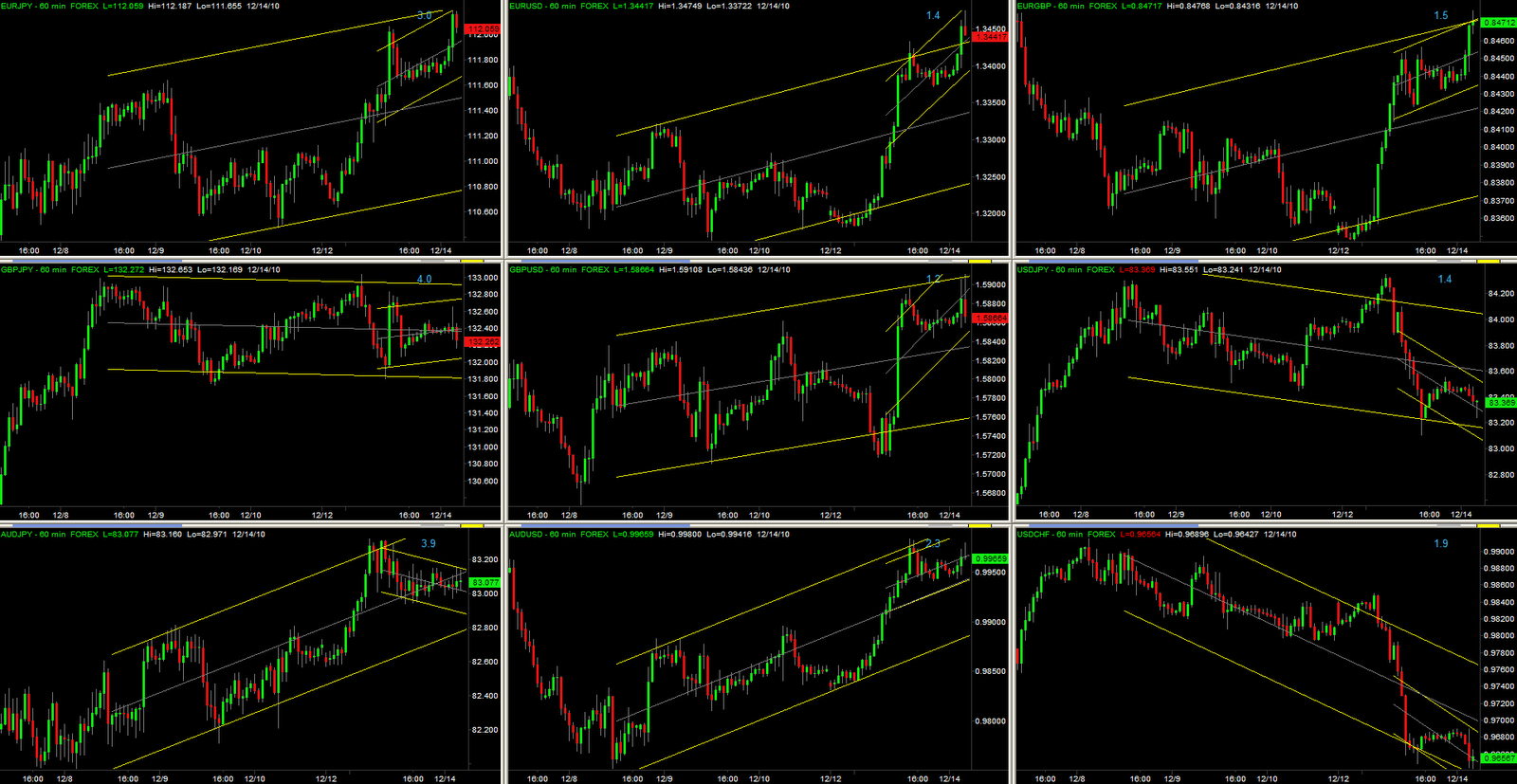

A channel is a delimited zone price movement of two lines: the main trendline, joining the higher lows in the case of an uptrend or lower highs in the case of a downtrend; and a parallel to this that links the higher highs in the case of an uptrend and decreasing minimum in the case of a downtrend line.

The price will tend to always move within that channel until the breakage thereof occurring, and it is precisely this movement that we tap into our operations.

How a channel is operated?

A channel provides many relevant to our operational information: it gives us entry points or profit taking whenever the price hits one of the two channel lines, and also helps us to place stop loss always outside the channel.

Anyway, we can say that the channels in the real market practically are never as perfect as the theoretical drawings that represent them. You may not always perfect steps are drawn from the bottom to the upper channel, or the parallel line (the trend observed more often) is not always touch. You have to know how to play with this feature.

You may also like to read another article on HeyGom: Trading in Forex: Money management techniques (averaging and pyramiding)

To operate a channel, it can be operating in favor of the trend channel, opening positions whenever the price touches the trend line, or counter trend operating it every time the price touches the parallel line has been drawn. As the price approaches the opposite line, we must close at least partially the operation. However, each touch of one end of the channel must be an approach what action should be taken at that point.

It is very interesting also operate the channel breaks, as are frequently accompanied by movements could gather a handful of pips. It is therefore especially interesting counter trend channels operate waiting a break and trend change it. Normally, a broken channel is always accompanied by a price retested using that channel to support its new movement, and that is precisely the optimal entry point.