When we talk about professional speakers, we are talking about every speaker who is available from a professional speakers’ agency. But most of these speakers have a particular topic or theme attached to their talk. They could be leaders in the world of business, they could be famous sporting men or women, and they could be entertainers or people who have achieved outstanding results in a particular field or fields of endeavour. But every one of these speakers is a professional. Their attitude and abilities are all thoroughly professional.Continue reading →

The principle of world’s most powerful marketing

As a customer, you’ve probably received literally millions of ad sales. Some of them work, most do not. Have you ever wondered why most of them do not work? Most likely it is because messages do not achieve any key point of differentiation between bid and another. This means that you have not been clear why choose one company over another.

If you are looking for a marketing campaign is to close more sales, then you must communicate clearly and effectively to your target market that you are different and also being one who best meets the needs of your customers.

To achieve this, you must use the most powerful marketing concept in the world to achieve greater profitability of your business … The “Unique Selling Feature” (CUV).Continue reading →

Get Your Business Going And Growing With These Expansion Techniques

If you’ve recently started a business and want it to be successful, it’s important to know that you can realize your entrepreneurial vision. To ensure that your small business becomes as successful as humanly possible, implement the following helpful expansion techniques:

1. Update Your Technology Equipment.

One expansion technique that can keep your business going and growing is updating your technology equipment. This strategy will help optimize your company’s day-to-day operations while also contributing to the cultivation of a cutting edge image for your brand. In the event that you’re in need of as400 iseries products and services, technology companies such as Infinite Corporation can help. Also note that there are now a wide range of technology businesses that run websites through which you can purchase hardware and software products. This can be very convenient for business owners who find the traffic and long waiting lines that result from traditional shopping to be tiresome and time-consuming.

2. Develop A Social Media Presence.

Another great way to ensure that your company keeps going and growing is by developing a social media presence. Doing so will enable you to connect with members of your target market in a very immediate, organic way. The best way to develop a strong social media presence is by hiring a digital marketing firm to do it for you. In addition to offering effective social media optimization (SMO) help, digital firms will oftentimes be able to provide the following brand-building services:

-crisis communications

-web design and development

-online reputation management

-search engine optimization

-social media optimization

-responsive web design

-press releases

3. Optimize Your Networking Efforts.

One final expansion technique that can really facilitate ongoing growth for your company is the optimization of your networking efforts. This strategy is important because sharing information about your brand with other people is one of the primary ways that you build your customer base and develop more business partners. There are several ways that you can optimize your networking abilities, and one is by taking an impromptu speaking class. Doing so will help improve your ability to speak clearly and concisely while also increasing your self-confidence when you interact with other people.

Conclusion

If you want your company to grow in a powerful and progressive manner this year, you can make it happen. Utilize the expansion technique processes outlined above to get the growth process underway right now!

The importance of recruitment

Unlike large corporations where huge investments in advertising media virtually guarantee that their products are “selling themselves”, the vast majority of SMEs using sales forces to market their products and this makes a fundamental difference.

Then success lies in the talent you have sellers, which depends not only on their training in the product, but a number of personal attributes that the sales agent must possess. The reality is that not all people have the same characteristics and, therefore, all are unfit to carry out successfully the work of sales.Continue reading →

What marketers look for in their ideal workers?

What makes the marketing team of a company achieve success? What that positions the company in an outstanding position to achieve their goals and connect with consumers? There are several abilities and talents that have been given keys over recent years in marketing workers. Skills in the digital arena, such as the domain in matters of data or knowledge of the ‘secrets’ of social networks, have been consideration by analysts as one of the main points to cover marketing teams.

Ask those responsible for these teams paint a very similar picture. A recent study by Spencer Stuart asked 150 marketing leaders are the key parts and are most desirable to form teams and marketing them from practice and direct experience, talents and skills have pointed also very on that line.Continue reading →

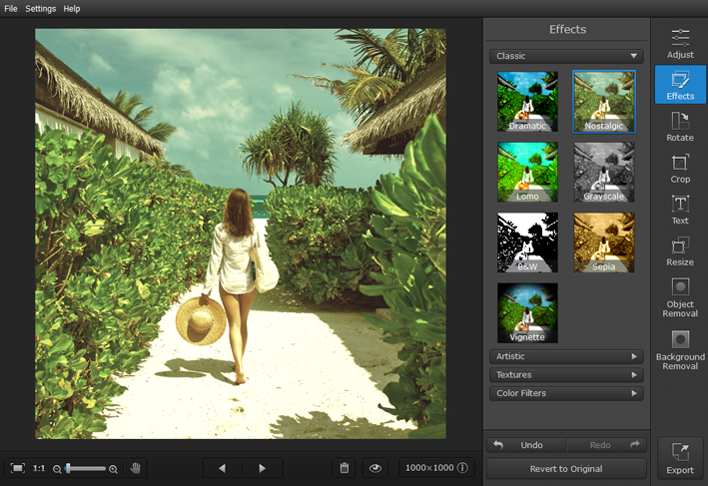

Review of the Movavi Photo Editor

While many people are interested in editing photos, few actually end up doing so. The reason for that tends to be the same in most cases: It often appears too complicated, and will require too much time.Continue reading →

A happier life in 15 steps

Is life can be easier, simpler, and easy? This question has many answers, so you never end up getting possibilities, solutions… but why not make it even easier? We share these 15 tips, which if applied, would make your life happier!

1) Waiver always right: Will always right is tired, creates stress and can even negatively impact on a relationship. Whenever you feel the urgent need to discuss for the win … asks yourself is better to be right or to be kind?

2) Relinquish your need for control: It is important to be willing to give up the need to have everything under control, you control everything always happens and what happens around you. Situations, events and people may not be under your control forever … lets everything flow and see!Continue reading →

What is viral marketing? Snowball Effect

You may have heard ever about the viral marketing or perhaps you already have a clear idea of what is and how it evolves, because effectively, and although the term “viral marketing” is born with internet marketing, the concept comes long before. In 1997, Steve Hurveston coined this term, when in an article published in Netscape M-Files, dominating spectacular success developed by Hot-mail to become a record time, the largest provider of email web. As we all know, Hot-mail precipitously got a base of millions of subscribers, offering free high demand in the market. Its success far exceeded any other marketing strategy. This success came to demonstrate how the Web and online marketing could be used effectively to attract the interest of potential customers to our offers.Continue reading →

Britvic in Good Position to Accommodate Sugar Tax

The new sugar tax will see the price of fizzy drinks rise across the UK and may see the profits of drink manufacturers adversely affected. Britvic, however, have been working towards a healthier portfolio of drinks for a number of years, and are in a good position to accommodate the changes.Continue reading →

Take the plunge from employee to entrepreneur

We reveal the experience of a senior executive who became employee to entrepreneur. If you are all ready to take the plunge?

Sometimes the routine can be our worst enemy and fear to break something established and well – known is a difficult obstacle defender.

In theory, life can be seen as a cycle in which a person between 20 and 50 years, spends most of his time working in a company, then get a comfortable and coveted retirement. The reality is that people who have what could be described as a lifetime devoted to work, know little rest and leisure.

However, those who realize that their experience is a wonderful tool to undertake not hesitate to use it to transform your future in the genuine realization of your dreams.Continue reading →